Capital allowances and super deductions

Contents[hide] |

[edit] Introduction

As part of the Government’s post COVID-19 recovery planning, two capital allowance relief initiatives became effective as of 1 April 2021. These relief measures, which run until 31 March 2023, are meant to encourage spending on new plant and equipment for use in a business in any event, as well as to assist companies that need to undertake such expenditures as part of their own strategy to recover from the effects of the pandemic.

[edit] Details

Office furniture, computer equipment and items such as photocopiers, scanners and telephone equipment, security systems and even carpeting all fall under the heading of plant and equipment.

The two relief measures are:

- A 130% super-deduction capital allowance for qualifying plant and machinery investment. The 130% allowance is for assets that would normally qualify in the main pool for capital allowances with a writing down allowance (WDA) of 18%.

- A 50% first-year allowance (FYA) for special rate assets. The 50% FYA is for assets that normally qualify in the special rate pool with a WDA of 6%. These are integral features such as air-conditioning, lifts and water heating systems.

[edit] Reasoning behind the initiatives

Reorganising space to deal with the consequences of the pandemic may well mean a substantial outlay on capital items, and these provisions are designed to alleviate the financial costs associated therewith.

The 130% allowance means that for every £100,000 of qualifying expenditure, the deduction for copropration tax purposes is 30% higher than what is actually incurred. At a corporation tax rate of 19% (current as of April 2021) this means an additional 5.7% tax savings on every £100,000 actually spent.

Items which are considered to be general in nature (i.e not long-lasting capital assets) do not qualify for this treatment.

Unfortunately, cleaning items, hand sanitisers and PPE (disposable or reusable) typically fall under the general expenditure. Therefore, capital allowances would not usually be applicable to these items.

And finally, if the assets are disposed of before 1 April 2023, a balancing charge will be due. This will allow HMRC to recover the tax relief given.

[edit] Annual Investment Allowance (AIA) applicability

Please note that these provisions do not apply to individuals or partnerships. For sole traders or partnership, the Annual Investment Allowance (AIA) is more appropriate.

The AIA continues to be available alongside the new measures and remains at £1m until 31 December 2021 before dropping to just £200,000. The AIA covers leased and second-hand assets.

--Martinc 16:24, 04 May 2021 (BST)

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

How can digital twins boost profitability within construction?

A brief description of a smart construction dashboard, collecting as-built data, as a s site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure bill oulined

With reactions from IHBC and others on its potential impacts.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

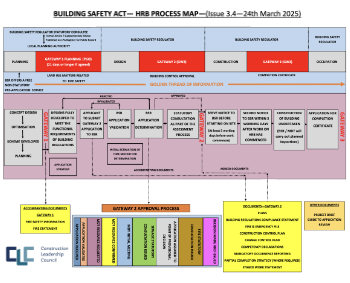

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.

Building Engineering Business Survey Q1 2025

Survey shows growth remains flat as skill shortages and volatile pricing persist.